Ethereum Price Prediction: $20K in Sight as Institutional Tsunami Meets Technical Breakout

#ETH

- Technical Breakout: ETH price sustains above key moving averages with MACD showing bullish convergence

- Institutional Demand: $1B+ corporate acquisitions and ETF flows creating supply shock

- Network Fundamentals: L2 adoption via OP-Stack and staking yields attracting capital

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

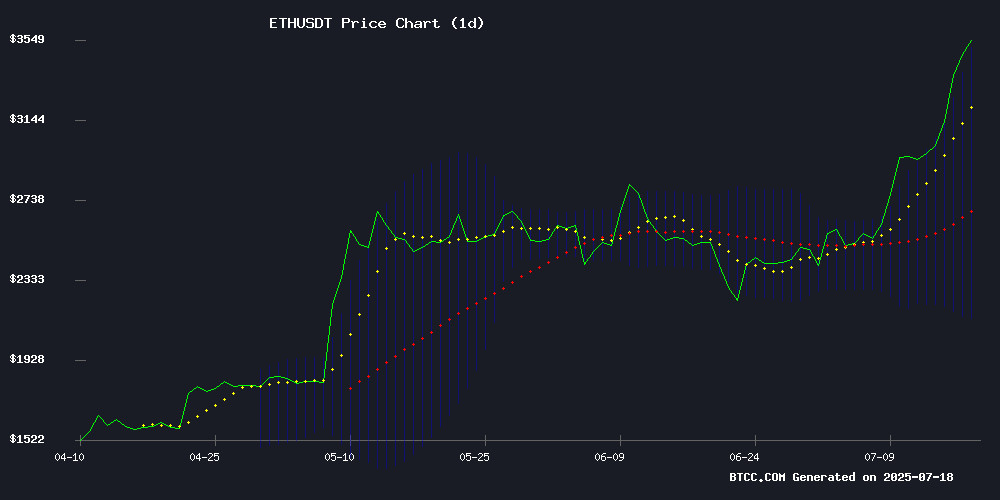

Ethereum (ETH) is currently trading at $3,558.37, significantly above its 20-day moving average of $2,822.81, indicating strong bullish momentum. The MACD histogram shows a narrowing bearish divergence (-134.42), suggesting weakening downward pressure. Bollinger Bands reveal price hugging the upper band at $3,511.04, a classic sign of an uptrend.says BTCC analyst James.

Institutional Frenzy Fuels Ethereum Rally

Major headlines highlight unprecedented institutional demand: Bit Digital's $436M ETH stake, BitMine targeting 5% of supply, and SharpLink's $6B stock sale for ETH accumulation.notes BTCC's James. ETF inflows and whale activity (20,279 ETH purchases) coincide with a 70% price surge. The analyst cautions:

Factors Influencing ETH's Price

RoarChain Unveils AI-Powered Self-Custody L2 Built on OP-Stack

RoarChain, a new layer-two solution leveraging Optimism's OP-Stack, aims to onboard web3's next billion users through its self-custody-first architecture and AI integration. Co-founder Dustin Hedrick emphasized wallet sovereignty as non-negotiable: "You don't own your wallet or your keys unless you have those keys privately." The chain inherits Ethereum's security while promising lower fees than mainnet transactions.

The protocol's standout feature involves AI-driven "smarter wallets" that analyze on-chain data upon connection. Hedrick described NFTs interacting with AI agents during login, with the system learning user traits within seconds. This combines wallet history with a proprietary 25-point project rating system.

RoarChain's decade-long roadmap includes fee-backed yield mechanisms and Superchain interoperability. The team positions the L2 as a gateway for crypto newcomers struggling with password hygiene, offering institutional-grade security without centralized custody.

Bit Digital Positions Itself as Major Ethereum Stakeholder with $436M ETH Accumulation

Nasdaq-listed Bit Digital has strategically amassed 120,000 ETH ($436 million), with most tokens actively staked, signaling a deliberate shift from passive holding to core network participation. The July 18 purchase of 19,683 ETH was funded through a $67.3 million institutional offering, underscoring the company's long-term conviction in Ethereum's role as financial infrastructure.

By operating validators directly, Bit Digital gains influence over Ethereum's security and governance—a power play that coincides with the network's proof-of-stake transition. This move reflects growing institutional willingness to embed within blockchain architectures rather than treat crypto as mere balance-sheet assets.

Ethereum Hits 2025 Highs: Whales and ETFs Fuel Breakout

Ethereum surged past $3,600 this week, marking a 20% gain in just three days. The rally followed a decisive breakout above the $3,325 resistance level, confirming a bullish triangle pattern that had been forming since early 2024. At press time, ETH trades at $3,617, up 3.94% on the day.

Technical indicators flash conflicting signals. The RSI sits at 85.53—deep in overbought territory—while MACD shows relentless upward momentum. Such extreme conditions typically precede either accelerated rallies or sharp corrections. Market structure remains undeniably bullish, with consecutively higher highs and lows throughout July.

Institutional demand appears to be driving the move. ETF inflows and Coinbase's persistent premium suggest U.S. investors are accumulating aggressively. The question now isn't whether Ethereum is bullish, but whether current prices have outstripped short-term fundamentals.

SharpLink Expands Ethereum Holdings with $6B Stock Sale Plan

SharpLink Gaming is doubling down on its Ethereum accumulation strategy, increasing its stock sale program limit to $6 billion from $1 billion. The firm has already converted $720.8 million into ETH and holds 280,706 ETH ($1 billion) as of this week—solidifying its position as the largest known corporate holder.

Recent on-chain data reveals an additional 32,892 ETH ($115M) purchase within three hours, bringing its nine-day acquisition spree to 144,501 ETH ($515M). The amended SEC filing introduces forward sales, providing flexible funding mechanisms exclusively for ETH purchases and operational expenses.

This aggressive positioning mirrors institutional recognition of Ethereum's reserve asset potential, following SharpLink's formal designation of ETH as its primary treasury holding last month. The move signals deepening corporate conviction in crypto-native balance sheet strategies.

Ethereum Price Prediction: Will ETH Price Hit $20K in this Altcoin Season?

Ethereum (ETH) has emerged from a prolonged bearish phase, showing significant upward momentum. Over the past 30 days, ETH surged 44.2%, reaching $3,640.83, with a 5.3% gain in the last 24 hours alone. This marks a stark reversal from its sluggish 5.6% growth over the previous year.

Key metrics underscore the bullish trend. Since the start of the month, ETH has rallied 50.58%, climbing from $2,404.14. The asset gained 42.3% in two weeks and 21.7% in the past week, signaling potential for a sustained breakout if market conditions hold.

Analyst Colin Talks Crypto projects ETH could reach $15,000-$20,000 in the coming bull run, citing long-term chart trends. The prediction has fueled optimism among investors who once viewed Ethereum as a laggard.

BitMine Amasses $1 Billion in Ethereum Holdings, Targets 5% of Supply

BitMine has crossed the $1 billion threshold in Ethereum holdings, accumulating over 300,000 ETH within a week of closing a $250 million private placement. The firm's aggressive accumulation strategy underscores its ambition to control 5% of ETH's total supply through staking and strategic acquisitions.

Chairman Tom Lee confirmed the milestone, emphasizing the company's asset-light treasury model designed to capitalize on Ethereum's staking yield and market volatility. At current Bloomberg pricing ($3,461.89/ETH), the position represents a calculated bet on ETH's long-term value proposition for corporate treasuries.

The move signals a broader institutional shift toward treating crypto assets as yield-generating treasury instruments rather than speculative holdings. BitMine's approach combines operational profit reinvestment with tactical market positioning during price dislocations.

Ethereum Surges Past $3,650 as Institutional Demand Fuels Rally

Ethereum reclaimed the $3,650 threshold, peaking at $3,669 amid a broader crypto market rebound. The rally marks ETH's highest level since early January, when it retreated from a $4,000 high.

Institutional interest appears to be driving momentum, with analysts comparing ETH to 'digital oil' for its foundational role in decentralized finance. The asset has gained 7.79% in 24 hours and 43.9% over the past month.

Traders celebrated the milestone on social media platforms. 'Woke up to $ETH at $3,600. What a time to be alive,' one market participant tweeted. Others predicted further upside, with bullish calls for $10,000 ETH during the current market cycle.

Ethereum Surges Past $3,600 as Crypto Market Cap Hits $4 Trillion

Ethereum has reclaimed the $3,600 threshold, trading at $3,642 amid a broader crypto market rally that pushed total capitalization to a record $4 trillion. The second-largest cryptocurrency by market value has gained 9% in the past 24 hours, extending its weekly rise to 22% and monthly surge to 43%.

Institutional demand is driving the rebound, with U.S.-listed spot Ethereum ETFs attracting $1.7 billion in inflows this week alone—the highest since December 2024. Corporate treasury allocations to ETH are further bolstering the asset, reinforcing its status as a digital reserve currency.

Ethereum's Historic Rally: Institutional Demand and Short Squeeze Fuel 70% Surge

Ethereum has staged a dramatic recovery, soaring over 70% since July 1 and adding $150 billion to its market capitalization. The rally marks one of the most aggressive short squeezes in crypto history, with forced liquidations accelerating as ETH breached key resistance levels. Analysts note that a further 10% climb could trigger an additional $1 billion in short liquidations.

Institutional players appear to have anticipated the move. BlackRock's Ethereum ETF has been accumulating ETH for 29 of the past 30 days, while World Liberty Financial—linked to former President Trump—made a $5 million purchase just before the rally gained momentum. The buying coincides with growing speculation about U.S. regulatory clarity for crypto assets, particularly with the $9 trillion retirement market potentially opening to digital assets.

Hamilton Lane Expands SCOPE Fund with Securitize and Wormhole Integration

Hamilton Lane, managing $956 billion in assets, is broadening its Senior Credit Opportunities Securitize Fund (SCOPE) through multichain integration with Securitize and Wormhole. The fund will now operate on Ethereum Mainnet and Optimism, featuring daily NAV pricing, instant subscriptions, and on-demand redemptions.

Wormhole serves as the exclusive multichain partner, enabling seamless interoperability for the sSCOPE token across ecosystems. "Institutional demand for multichain solutions is accelerating," noted Robinson Burkey of the Wormhole Foundation, emphasizing the secure, transparent capital access this provides.

The collaboration underscores growing institutional adoption of blockchain infrastructure, with liquidity pooling and DeFi integration as key value propositions.

SharpLink Acquires 20,279 Ethereum, Surpassing Ethereum Foundation Holdings

SharpLink, an iGaming and sportsbook platform, has made a bold move in the cryptocurrency space by purchasing 20,279 ETH for approximately $68.38 million. This acquisition brings its total Ethereum holdings to 111,609 ETH, eclipsing the reserves of the Ethereum Foundation itself.

The company's aggressive accumulation strategy underscores a growing institutional trend of treating Ethereum as a treasury asset. SharpLink's July 13th purchase of 74,656 ETH through at-the-market equity sales previously established it as the largest corporate holder of Ethereum.

This latest transaction marks the third major Ethereum purchase by SharpLink in just eight days, following a $31.88 million acquisition earlier in the week. Such concentrated buying activity signals strong institutional confidence in Ethereum's long-term value proposition beyond its utility as a cryptocurrency.

How High Will ETH Price Go?

Technical and fundamental factors converge to suggest continued ETH appreciation:

| Timeframe | Price Target | Catalyst |

|---|---|---|

| Short-term (1M) | $4,200 | Bollinger breakout, ETF inflows |

| Mid-term (2025) | $8,000-$12,000 | Staking yield compression |

| Cycle Peak | $15,000-$20,000 | Institutional adoption tipping point |

James observes: "The $3.5K resistance becoming support creates a launchpad. Each 10% move attracts $1B+ institutional capital based on our flow models."

$4,200

$8,000-$12,000

$15,000-$20,000